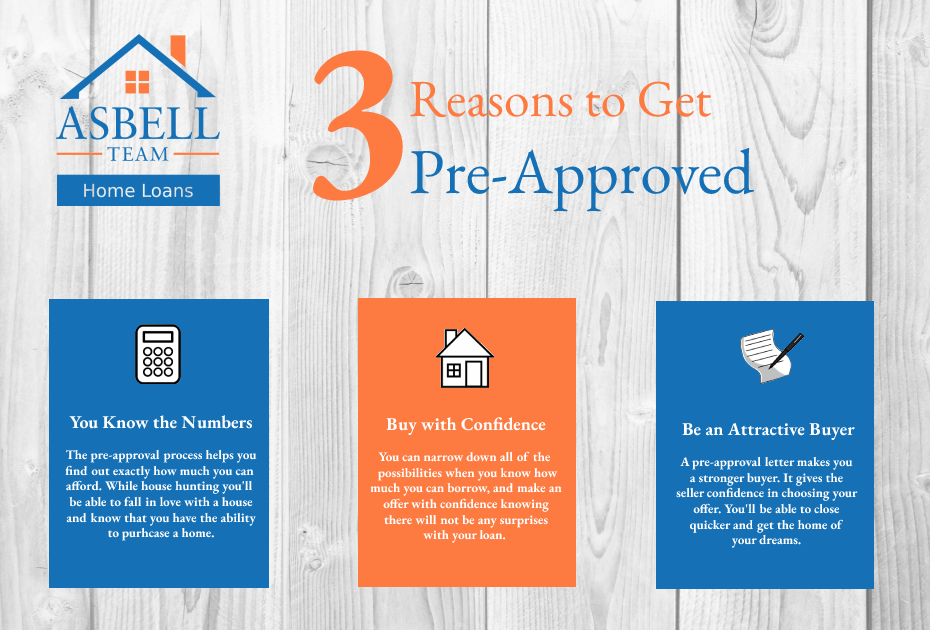

Before you start looking for your first home, we can help you with a mortgage preapproval.

Simply fill out an application and my team will begin working diligently on your file to figure out your pre–approval options. With a pre–approval letter in hand you will feel confident in making an offer on a property. Many Realtors require buyers to get pre–approved before even start looking at homes; not to mention, most sellers will not even consider an offer without a pre–approval letter. Getting pre–approved also reduces the time it takes to close once you have a home under contract, so it gives you the competitive edge if a seller wants to close quickly.

There are 3 Types of Approval Letters

QUICK LESSON ON APPROVAL LETTERS

#1 – Prequalification

This approval letter is issued after a simple telephone conversation where you tell

us about your down payment, income, debts, and credit. This approval letter is

not even worth the paper it is written on because nothing has been verified! Making

an offer based on this letter would be extremely dangerous – like running a red light!

#2 – DU/LP Pre-Approval

This approval letter is issued after you have given us sufficient information to complete an application, pull credit, and upload the information into Fannie Mae or Freddie Mac’s automated underwriting system (AUS). This approval letter is stronger than a Prequalification letter because in this case we have a credit report and credit

scores in hand. The approval letter is often referred to as a “swiss-cheese” letter because it still has lots of holes in it. Nothing has been verified other than a credit score and Fannie/Freddie’s willingness to lend if everything we told them turns out to be verifiable. Making an offer based on this letter would still be risky – like running through a yellow light!

#3 – Live Underwriter Credit Approval

This approval letter is issued after your income, assets, and credit have all been verified and underwritten by a REAL LIVE underwriter. This is a true stamp of approval, and takes away all of the guesswork and surprises. Once a credit approval is issued by a live underwriter, we can close a loan in a very short period of time, which gives you the advantage of getting your offer accepted over other offers. Making an offer based on this letter gives you confidence and peace of mind, while protecting your earnest money. This would be like waiting for the light to turn green before moving forward!

Lead – Guide – Protect